Bangalore, India is home to Canara Bank, a public sector bank in India. founded in Mangalore in 1906 by Ammembal Subba Rao Pai. In 1969, the bank was nationalised. In addition, Canara Bank maintains offices in New York, Dubai, and London.

CEO: K. Satyanarayana Raju (7 Feb 2023–)

Founded: 1 July 1906

Founder: Ammembal Subba Rao Pai

Headquarters: Bengaluru

Number of employees: 82,638 (2024)

Revenue: 1.39 lakh crores INR (US$17 billion, 2024)

Subsidiaries: Canara Robeco Asset Management Company Limited, MORE

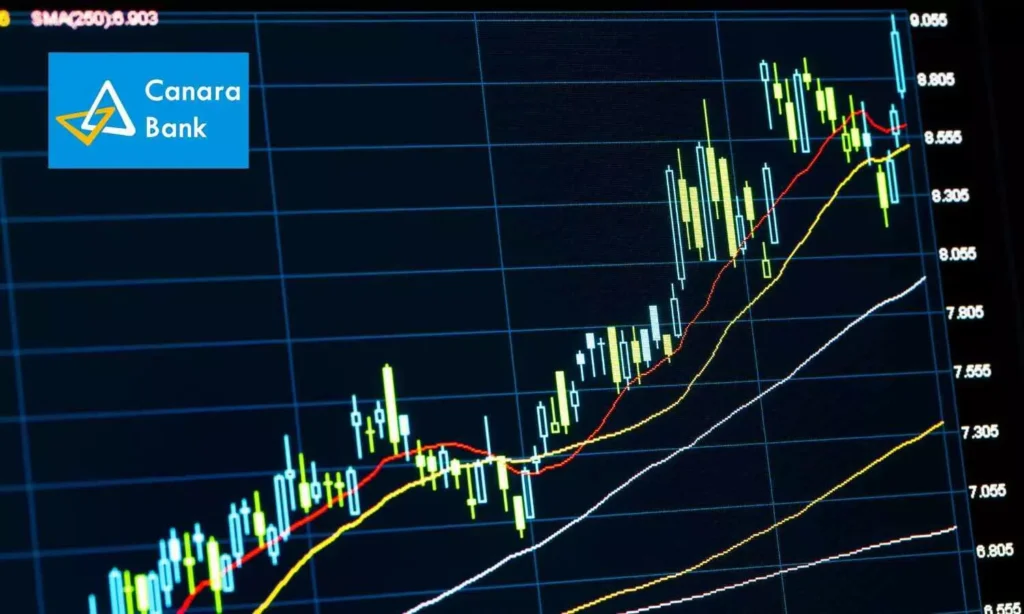

On December 4th, 2024, Canara Bank‘s stock gained 3.04%, outperforming the sector by 1.01%. It has been on a consecutive rise for 2 days, with a 6.59% increase. The bank’s moving averages are higher than the 5-day, 20-day, 50-day, and 100-day averages, but lower than the 200-day average. Public banks have also gained by 2.03%. Canara Bank offers a high dividend yield of 3.06% and has outperformed the Sensex in both 1-day and 1-month performances.

PROS:

The stock is now selling at 1.04% of its book value.

Over the past five years, the company has produced strong profit growth at a 90.8% CAGR and has been maintaining a respectable dividend distribution of 19.2%.

CONS:

The interest coverage ratio of the company is poor.

223,809 Cr in contingent liabilities.

The business may be capitalising the interest expense.

Earnings include Rs. 30,853 Cr. in other income.

CURRENT PERFORMANCE OVERVIEW:

With a market valuation of about ₹95,378 crore, Canara Bank’s stock is now trading at about ₹106.33. With more than 1.28 crore shares moved, the stock has had high trading activity, suggesting that investors are quite interested in it.

CANARA BANK SHARES KEY PRICE METRICS:

The current low is ₹105.57.

The high for today is 106.99

52 Weeks: ₹82.69 / ₹128.90 Low/High

₹105.12 was the previous close.

Price at opening: 105.90

Traded Volume: 1,28,24,776 Shares

The market value is ₹95,378 crore.

CANARA BANK SHARES ANALYST RECOMMENDATIONS:

The results of 13 analysts’ combined analysis provide a mixed picture:

Purchase: 54%

Hold: 23 percent

Sell: 23 percent

CANARA BANK SHARES EXPECTED TARGET PRICE:

With projections ranging from a low of 83 to a high of 140, analysts have set a consensus price target of around 125 for Canara Bank’s shares over the course of the upcoming year. This shows that the bank’s performance in the upcoming months is expected to be positive.