WHAT IS PAN 2.0 PROJECT ?

Project Panning is the practice of concentrating on completing the items in your collection rather than purchasing new ones. It would be necessary to clear the extremely large collections of many of the bloggers and content producers working on these panning initiatives.

FAQ:

WHAT IS PAN 2.0 USED FOR ?

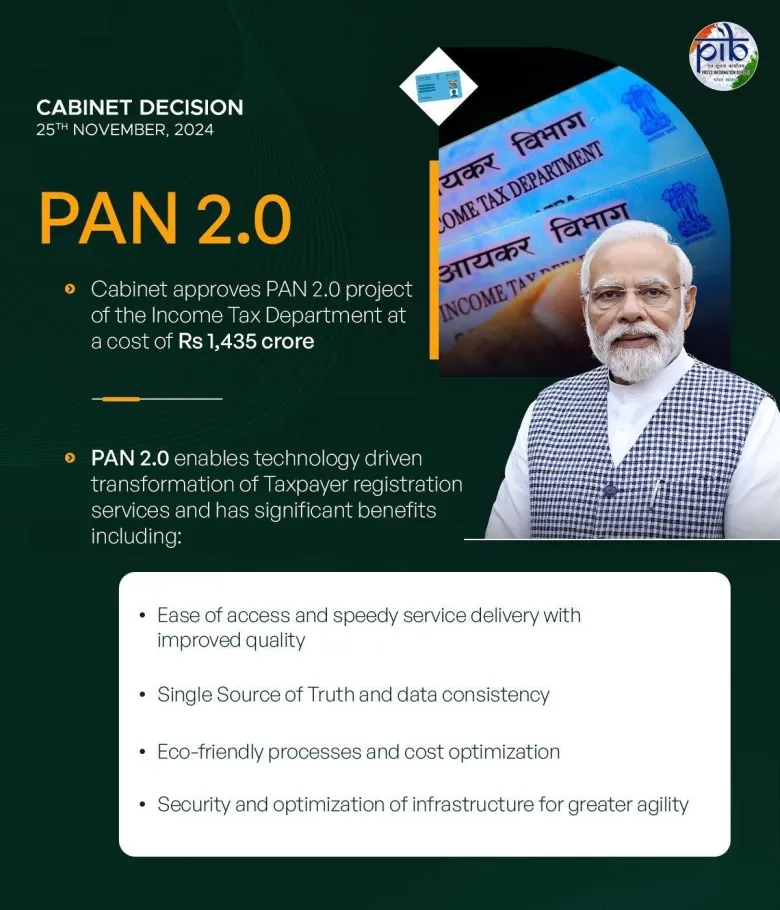

By utilising technology to revolutionise PAN and TAN procedures, the PAN 2.0 initiative re-engineers taxpayer registration services. For increased efficiency, it unifies all PAN/TAN operations and validation services into a single ecosystem. The system redesign will replace the PAN/TAN 1.0 ecosystem and improve infrastructure.

WHO INTRODUCED THE CONCEPT OF PAN 2.0 ?

The Indian government first proposed the PAN concept in 1972, and section 139A of the Income Tax Act of 1961 made it a law. Originally voluntary, PAN became required for all taxpayers in 1976.

WHAT IS THE MAIN USE OF PAN ?

In terms of taxes, a Permanent Account Number, or PAN card, is an essential document. Additionally, it acts as identification documentation for a variety of financial services, such as applying for a credit card, opening a bank account, and investing in mutual funds.

WHERE IS PAN USED FOR ?

Devices including PCs, cellphones, tablets, and personal digital assistants may exchange data thanks to a PAN. PANs can be used to connect to a higher level network and the Internet, where a single master device acts as a gateway, or they can be used for communication amongst the individual devices.

WHAT IS IN A PROJECT PAN ?

The goals, objectives, and activities your team must complete for a particular project are outlined in a project plan, also known as a work plan. Schedule, scope, deadlines, and deliverables at every stage of the project lifecycle should all be covered in your project plan.

WHAT IS THE USE OF PAN FULL FORM ?

PAN stands for Permanent Account Number in its entirety. The Department of Income Tax issues the ten-digit PAN card, which is an alphanumeric character. PAN is made up of both alphabetic and numeric digits.

WHAT IS THE BENEFIT OF PAN INDIA ?

First and foremost, it is a mandatory requirement for filing income tax returns in India. With a PAN, an NRI can effortlessly keep track of their tax obligations, claim refunds if applicable, and avoid the withholding of taxes at higher rates.

WHO IS THE FATHER OF PAN ?

In most tales the god Hermes is Pan’s father.

WHO IS THE BOY IN PAN ?

Levi Miller

In this vividly-realized tale, an orphan kid (Levi Miller) learns he is destined to be Peter Pan and is sent to a magical place to fight the terrifying pirate Blackbeard (Hugh Jackman) with the aid of the warrior women Tiger Lily (Rooney Mara).